It shot around the Internet yesterday, like so many other viral stories do, and all I could do was roll my eyes. It was the story of an exuberant 8-year-old boy in Connecticut leaping into the arms of his aunt upon seeing her, and her resulting injury, a broken arm.

The story was one that any adult could imagine. The woman testified:

All of a sudden he was there in the air, I had to catch him, and we tumbled onto the ground…I remember him shouting, ‘Auntie Jen I love you,’ and there he was flying at me.”

People were aghast. One only needs to read the comments of any article on the subject. How could you sue a beloved relative? And how could you sue a child?

But suing relatives (or close friends) happens all the time, particularly in auto collisions. Who, after all, are you most likely to be with at the time of a collision? A close friend or relative. Unless you drive a taxi, you don’t often have strangers in your car.

And it’s the same with your home, in that the most likely visitors inside are family and friends.

When I first saw the aunt-nephew story, my first thought was that homeowner’s insurance would cover the incident if there was liability, and that this was similar to suing a relative over a car crash. I tweeted as such:

This is, in fact, one of the reasons we have insurance. To cover us in case we slip up and someone is injured due to our negligence.

Certainly insurance companies would prefer that folks don’t sue. It would be a great business model, wouldn’t it, to keep collecting all those premiums and never pay anything out?

In a story later in the day yesterday, the jury came back with a defense verdict — one juror said the jury simply didn’t think the boy was negligent when measured against the reasonable conduct of a child his age. OK, I can live with that.

At some point we all grow up and become increasingly responsible, and that line of responsibility won’t only be gray for a child’s conduct, but ever-shifting depending on what happened. (see, for example, a 4-year-old sued in NY along with parent for negligent supervision.)

Would I have taken such a case? No. Because the jury did what I expect a jury would do. But eviscerate her on the Internet for it? No. She took the advice of counsel. Bad judgment call perhaps, though the attorneys defend the decision to move forward (see update).

And the injured woman was interviewed and confirmed my thoughts: Suit was brought against the homeowners policy to cover the medical bills, but you don’t sue the insurance companies, you have to sue the individuals. From CNN, who interviewed the Aunt:

“This was meant to be a simple homeowners insurance case”

Also at the CNN story, the woman testified that she remains close with the family and recently took the boy (now 12) shopping for a Halloween costume.

As with so many other things on the Internet, many people will howl and yell first due to the way a headline is written, without bothering to think that the actual conduct isn’t particularly egregious. The case may have been a loser, but it was not worthy of spilling all the resulting venom.

Update: On her attorneys’ website is this message about the case and the desire to get the medical bills paid:

“From the start, this was a case was about one thing: getting medical bills paid by homeowner’s insurance. Our client was never looking for money from her nephew or his family. It was about the insurance industry and being forced to sue to get medical bills paid. She suffered a horrific injury. She had two surgeries and is potentially facing a third. Prior to the trial, the insurance company offered her one dollar. Unfortunately, due to Connecticut law, the homeowner’s insurance company could not be identified as the defendant.”

“Our client was very reluctant to pursue this case, but in the end she had no choice but to sue the minor defendant directly to get her bills paid. She didn’t want to do this anymore than anyone else would.” But her hand was forced by the insurance company. We are disappointed in the outcome, but we understand the verdict. Our client is being attacked on social media. Our client has been through enough.”

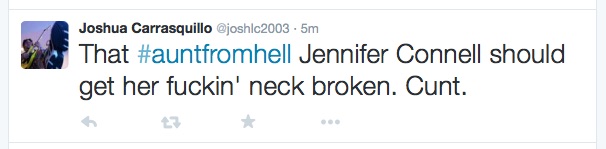

Updated x2: These are examples of what Twitter has to offer. Remember, this is suit is essentially about whether homeowner’s insurance will pay the medicals. The first from Joshua Carrasquillo of Lowell Massachusetts:

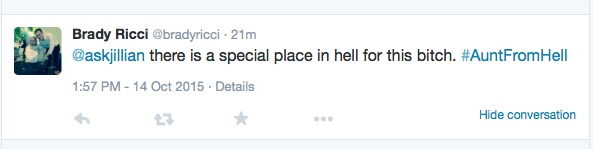

And the second from Brady Ricci of Vail, CO and Los Angeles:

And this is from Jack Marshall, who says he actually teaches ethics and has a blog called Ethics Alarms (coded “no follow“):

What’s going on is that Aunt Jennifer is pure hellspawn, a mysteriously animated pile of human excrement that embodies the worst of humanity.

This is what happens when people elect to post stuff on the web based on an initial news report that was, shall we say, very selective on what it chose to report.

Update x3: This site is getting quite a bit of traffic, most likely from many who never knew it existed. So let me answer a question some of you may have: Yes, I know what it’s like to be on the receiving end of lawsuits, and they weren’t nearly as benign as this run-of-the-mill kind: On Suing and Being Sued

Update x4: Why did this little suit get national attention? Because of the way the original author wrote it — designed for clickbait, not accuracy. See: The Media Hit Job on the Evil Aunt

Not unreasonable if what I was reading today – $127,000 in damages – was the claim. But articles I was seeing yesterday asserted she was claiming $5M in damages or some such. *That* would be outrageous.

But articles I was seeing yesterday asserted she was claiming $5M in damages or some such

Some states may still have those stupid ad damnum clauses where you are forced to stick a number in a complaint, even when you don’t know how bad the injury will ultimately be. Assuming that is what you are referring to, I’ve addressed that issue a number of times, linked here.

I realized it was just the normal insurance play, but come on, this was just too funny not to ridicule. Can’t we have some fun too?

I realized it was just the normal insurance play, but come on, this was just too funny not to ridicule. Can’t we have some fun too?

Sadly, most sites have published and re-published her name. She’s paying the e-shaming price because she followed legal advice on a poor liability case.

And because few articles discuss that this was actually an action against a homeowners policy, the public gets one more reason to hate lawyers when we step in for voir dire. All I see is one more hurdle to leap.

So no, the big picture says you can’t have fun too.

That’s what I figured; it would have been easy for hysterical msm to point out it was an insurance case, like those who sue family members when they bust their leg on a bad step. But that wld have destroyed the story.

it would have been easy for hysterical msm to point out it was an insurance case, like those who sue family members when they bust their leg on a bad step. But that wld have destroyed the story.

There’s no question that it makes for a more “fun” story when you leave out the actual target and go with the fiction that the kid would be responsible for payment.

And grossly misleading and unfair.

Oh, the terrible terrible choices those rich people have to make! I shed copious tears–the suffering must be unbearable. It would be a mercy to put them all out of their misery.

Oh, the terrible terrible choices those rich people have to make! I shed copious tears–the suffering must be unbearable. It would be a mercy to put them all out of their misery.

I have trouble figuring out if this is just another spammer/troll. Rich people? This story was about rich people?

The dropped-in URL to a website was, of course, deleted.

Pingback: Jennifer Connell Is Not Really a Monster For Suing Her 8-Year Old Nephew - Windypundit

Thanks for clearing this us, and for the level headed analysis.

One thing that occurs to me, is that there IS a villain in this story, it’s the insurance company. Regardless of whether the actually leaked the story or not, they should pay out on the premium. I’m wondering if there’s a way to find out and expose which company it is so others can stay away from them.

One thing that occurs to me, is that there IS a villain in this story, it’s the insurance company.

I’m glad you brought that up. While some types of insurance in some places may pay out automatically for an injury (such as No-Fault with cars), that doesn’t mean it applies to homeowners insurance. I think that is a common error. So the insurance company, if they believe that their client was not negligent (didn’t act with reasonable care given the age/circumstances of the insured), was well within its right to defend.

What would you sat to the less hysterical critics I’ve run across, who say she had a middle-class job, so why wouldn’t her insurance cover these losses?

What would you sat to the less hysterical critics I’ve run across, who say she had a middle-class job, so why wouldn’t her insurance cover these losses?

I have not seen any information on what her insurance did, or did not, cover. I decline to speculate.

Insurance isn’t just some pot of free money, it’s there to protect the insured from their own mistakes. The plaintiff deserves every bit of ridicule she received for suing. A responsible adult would maintain her own health and disability insurance to protect herself from unforeseen events.

A responsible adult would maintain her own health and disability insurance to protect herself from unforeseen events.

I have not seen any information on what her insurance did, or did not, cover. I decline to speculate.

She couldn’t even hold a plate of hors d’oeuvres at a party she attended. Oh, the humanity!

She couldn’t even hold a plate of hors d’oeuvres at a party she attended. Oh, the humanity!

You have run head long into the selective writing of the “journalist” who wrote the story up. Given that she had a busted arm, and has already had two surgeries and may have another, she likely had trouble with a wide range of activities including the simple act of getting dressed in the morning. Go ahead, spend some time tying your shoes, buttoning your shirt and taking a shower with one hand. Then go shopping and bring the groceries up three flights of stairs and cook. And try to use a knife one-handed.

The original article, as it was written, looks like a hit job by someone with an agenda to mock and ridicule. Which was both successful and, in my opinion, completely misleading and dishonest.

The true criticism deals with the liability aspects of the suit, not the damages.

@Eric Turkewitz – I guess it comes down to the PURPOSE of the insurance.

If it’s to cover accidents and unforeseen (hence unbudgeable) events, then they SHOULD pay. If it’s a shield against legal exposure then they should fight.

But I think the crux of the matter is that no homeowner buys insurance as a legal shield. They WANT the protection against accidental and unforeseen events.

Maybe she had an agreement with the family to share the claim $$4 as they wouldn’t be out any money with Insurance paying her….?? …..Ever think about that???

Maybe she had an agreement with the family to share the claim $$4 as they wouldn’t be out any money with Insurance paying her….?? …..Ever think about that???

It would not surprise me in the least if she told the family she would only accept compensation from the insurance proceeds. She was quite clear that there was no bad blood in the family and that she recently took the boy shopping for a Halloween costume.

I’ve had a number of clients tell me — in cases where the tortfeasor was a stranger, not even family — that they did not want to go after personal assets. If there was something particularly egregious involved, such as alcohol or a sexual assault, that would naturally be less likely to happen.

@Steve M. – Because they want the *other* insurance company to pay for it.

Jennifer is a wonderful, and sweet woman. it’s cruel how the social media have condemned her.

Jennifer is a wonderful, and sweet woman. it’s cruel how the social media have condemned her.

Even if she wasn’t wonderful and sweet, and was just plain vanilla, it was still cruel.

wait, so an insurance company is requiring a judgement against the insured before they pay a claim? Isn’t that what adjusters are for, to determine the extent of liability and the amount to pay on an insurance claim? And if they said the amount of liability was $0, how would a verdict against the insured change that?

@Dave Weinstein – Why should it pay out? Homeowners insurance covers acts of negligence. I don’t believe it was negligent for an 8 year old to hug-jump his aunt.

thanks for this reasoned – and reasonable – explanation. 🙂

Sorry, but I’m calling bullshit. I don’t care if it was the intention to get money from the kid or from the insurance. “Horrific injuries”??? This woman had a BROKEN WRIST. My brother was rear ended on his motorcycle. Broke the orbital bone around his eye, fractured his skull, broke every bone in his hand and wrist and his arm, broke his hip, broke his pelvis. THAT is an example of “horrific injuries”. A broken wrist that she whined kept her from holding a platter of h’ors d’oeurves? No. Not even close.

A broken wrist that she whined kept her from holding a platter of h’ors d’oeurves? No. Not even close.

Like many others, you are confusing her actual injuries with what the reporter elected to portray.

@Dave Weinstein –

I first learned that homeowners insurance covers liability for negligent acts in my torts class, so you’re probably right that most homeowners jus want insurance for your everyday accident, like a tree falling on your house or a fire, but I’m sure if more people knew that their insurance could be used as a shield against financial responsibility in a lawsuit against them then they would want that coverage as well.

Jack Marshall and his site are quite literally one of the worst cesspits on the internet. It usually comes down to his bloviating on “Ethics” as it matches up with his personal opinion and nothing else and then chastising those who dare to disagree (Thanks for nofollow on that by the way).

I will never forget the hilarity of his attack on you for the April Fools thing a while back.

@Eric Turkewitz – I had a similar injury in 1996 for which the homeowner’s insurance paid the liability limit. I am now recuperating from the 23rd surgery on the same arm. No further payment is forthcoming from the insurance company.

Shouldn’t you all be shocked and dismayed that this is how your health and legal system works? If this happened to me, A quick trip to the hospital and I am helped for free. It seems like your anger is all misplaced. The whole thing is ridiculous for a non American.

Amen! And just think of all the insurance industry middle-men AND lawyers (with all due respect) that have to be paid in attention to the already-bloated medical bills. The insurance and medical industries and our Capitalist-worshiping politics are the real evil here, not some woman forced to navigate the system.

My aunt and cousin were riding with my dad when he broadsided a truck that pulled out of a side road, trying to cross the highway. The driver of the truck was at fault, but since he was under-insured, my aunt and cousin had to sue my dad to try to get his insurance to pay for their injuries.

[remainder of long, personal story deleted…writer says sometimes you have to sue relatives and make sure you have adequate insurance– ET]

Was there a claim for pain and suffering as well or was the sole claim reimbursement for medical expenses? Not to be naive, but if the latter, how do you lose a case like that? For the matter, if the insurance angle is true, how the f*** does the carrier refuse to offer more than a dollar?

And did Connell not have medical insurance of her own? If so, what was the coverage problem there? A refusal to cover the incident because of the way she was injured? If so, did she pursue, let alone exhaust, remedies there?

Of course, if Connell was uninsured herself, maybe she should just go to Plan B and file for bankruptcy and screw all the healthcare providers.

Great, enlightening piece, but I clearly still have questions.

None of this would have been an issue if we had a single-payer healthcare system.

Why? I pay for my own health care policy and it doesn’t prevent anyone from suing me.

The commenter means that if you eliminate the insurance industry from the equation, this is not an issue. Single-payer might not have been the right wording… not sure. Maybe universal healthcare. Of course it might not be completely true since there will still be people deciding what does and doesn’t get covered, but in a system working for the patient’s best interests instead of the insurance industry’s best interests, this would not be an everyday occurrence.

Part of the outburst online may have been that people in other countries don’t understand the need to sue to get an insurance claim. Perhaps after a car (auto) accident suing a family member happens in the UK; I’ve never heard of it though.

So to us saying you sued a friend’s child, even to get medical costs paid by insurance, is like saying you went and had lunch Jupiter.

I’ll stand on my analysis, Eric. I don’t care why she sued her nephew when it was—I will say obviously—a cruel and venal thing to do. At best it was stretch of a negligence claim, and balancing interests and harm, and awful call to put the child through that, or to have a kid’s recently departed mother’s sister—I wonder if she was his godmother too?—appear to turn against him in what must have been a bewildering encounter. You say you wouldn’t have taken the case, which doesn’t surprise me. Still, I don’t blame the lawyer, unless he didn’t tell his client enough to make a better decision than she did.

Everyone keeps saying that the Aunt Had to sue the child. No, she didn’t. She only had to sue the child if she cared more about the money than she did about the kid, and has adopted the theory, understandably popular with trial lawyers,but not so much with aunts, that every accident has to be somebody’s fault.

Your argument is, essentially, that “everybody does it” (I don’t think anyone has sued the 8-year old driver of a car, though.) Well, that’s not an ethical argument. That’s a rationalization. The post wasn’t about legal ethics, because the lawyer, as I said, didn’t do anything wrong: the child was just another defendant to him. This is family ethics. The fact that the child is still willing to trust the aunt is moral luck, and proves nothing relevant to the decision to sue.

One of the things I teach in legal ethics seminars is that just because the Rules say you can do something doesn’t mean its the right thing to do, or that the harm you bring on your client’s adversary is necessarily fair or right. (There’s a famous Abe Lincoln letter to a potential client on this topic that is often taught in law schools, as you probably know.

I didn’t bring in the insurance issue, which I thought might bein there, because in terms of how a trusted adult treats a child in the family, it doesn’t matter.

I concede your point that “hellspawn” was over the top. But she’s an awful aunt.

…awful call to put the child through that…appear to turn against him in what must have been a bewildering encounter.

What orifice did you pull this from? There isn’t anything about the kid being traumatized, or failing to understand what insurance is. If you’d bother to read before ranting you might learn they just went shopping together for a Halloween costume. (A Jack Marshall mask?)

Everyone keeps saying…

Oh boy, that is certainly a good basis upon which to do legal analysis.

One of the things I teach in legal ethics seminars is that just because the Rules say you can do something doesn’t mean its the right thing to do.

Yup. For instance, you can publish things on the Internet without thinking. But that doesn’t mean you should.

One last comment for Jack Marshall and his complete speculation that the kid would hate her, and that there was therefore some ethical issue:

Both she and the kid appear on the Today Show today. And the kid said of his aunt, “She would never do anything to hurt the family or myself… I love her and she loves me.”

There is literally no point in engaging Jack Marshall. His response will always be to double down, and then double down again when faced with a rational counter-argument. He has some sort of condition that causes him to believe that he can build a sturdy tower of ethics on the shifting sands of his personal feelings. He never apologizes because he conflates the concept of things that are right with things that he likes, and things that are wrong with things he doesn’t like, meaning that as long as he likes himself, he will always be right. It doesn’t matter that his personal politics clearly bias his ethical beliefs, or that he will dive headfirst into an arena he knows nothing about and boldly assert that “Marshall’s Ethics” shall govern, notwithstanding existing ethical standards. He lacks the capacity to distinguish between his personal opinions and an ethical framework that exists independent of Jack Marshall. That he is teaching his distorted view of the world to others is truly unfortunate; however, if a ham sandwich can get indicted by a grand jury, it is hardly a surprise that an under-cooked turkey burger can end up teaching a CLE course. Even if said burger wouldn’t know ethics if Plato came back from the dead and bit him in the ass.

@Jack Marshall – You’ve got to be kidding me.

“Your argument is, essentially, that ‘everybody does it'”

No, you buffoon, the argument being made is that when a state requires one to follow specific legal procedures in order to obtain necessary finances to cover an injury that isn’t one’s own fault, and the only other alternative is to potentially face bankruptcy in needing to pay over $100,000 (one-hundred-thousand dollars) in medical bills, /the state’s requirements become what one must do/.

If this is a family ethics question, the only ethical breach I can conceive of as having been likely to happen would have been for the parents of the child to attempt to coerce the aunt into /not/ suing the child over illusory issues like the ones you’re bringing up. In that hypothetical situation, the parents would have been damning a close relative to what is, for most people, nearly-insurmountable medical debt – all for the sake of protecting their child from sitting in a chair and answering a few questions. Fortunately, the parents aren’t as ethically-challenged as you are, and they chose not to do any such thing. Rather, they understood that the options for the aunt were to go the route that the state has provided or be unduly financially burdened, and volunteered their full cooperation for a family member they care about.

I pity your family members. God forbid they ever find themselves depending on your compassion in the face of legal red-tape which can’t be circumvented.

I’d give my unbroken wrist for a LIKE BUTTON. One I could click a hundred times for this post.. especially that last paragraph.

HOW DARE YOU BRING REASON, COMMON SENSE AND FACT-BASED DESCRIPTIONS TO THE INTERNET!!!

Don’t you know this is where “angries” dwell?

This lawsuit situation is so commonplace I’ve been waiting to here the real story since yesterday.

Great post, great blog…glad I found it.

@Hazel – The superiority of whatever national system you’re referring to isn’t as clear as you’d like it to be. Ask the thousands of Canadians who flock to the US to privately pay for healthcare that isn’t substandard. There’s also this thing called Obamacare that you may have heard about. But all that is beside the point, because I think there’s confusion about the insurance issue here. There is no suggestion whatsoever that the plaintiff here was medically uninsured, so no, this case is not about some desperate woman pleading with society to save her from unpaid medical bills for which she now has no recourse.

@Peter – Again, that’s not what this case was about though. If she had health insurance, and her lawyers have not suggested otherwise, then her medical care has already been paid for by her health insurer.

Jack Marshall has a very strange set of “ethics”. I used to respond to posts on his site until it got too ridiculous.

Pingback: The Media Hit Job on the Evil Aunt – New York Personal Injury Law Blog

@shg –

It’s not “fun” when you’re the person being ridiculed.

Pingback: On Broken Wrists and Suing Children | The Legal Satyricon

@shg – wtf? Why can’t we have fun at this poor woman’s expense? That attitude is the problem. Her name is being smeared AND she has a couple hundred thousand in medical debt plus any lasting disability. Why would you want to have fun?

@Rick Rutledge – Whats really bad is that even though she didn’t win and the 12 yr old won, the 12 ur old and family really didn’t win because they incurred legal fees to defend their innocence. My wife and I have and provide a legal insurance policy …[self-serving advertisement deleted –ET]

Whats really bad is that even though she didn’t win and the 12 yr old won, the 12 ur old and family really didn’t win because they incurred legal fees to defend their innocence

Homeowners insurance pays for the defense. Go peddle your products elsewhere.

@Hazel – Hazel, I couldn’t agree with you more!! The real problem here isn’t the Aunt. The legal explanation make it very, very clear: we’re so messed up that in order to get health care, you have to sue a family member so a private insurance company will pay out on a policy it wrote, so you can afford the health care. *shudder*

@Dix – privatized Healthcare is great.. however not affordable unless you’re rich… so as a Canadian. .. I can wait an extra week for a surgery that is performed by some of the world’s best doctors at a 0% fee.

Don’t knock the Canadian way of Healthcare. . Walk a mile in our shoes… our Healthcare is Not Obamacare.

@Eric Turkewitz – It is quite possible that they had a deductible to meet.

Pingback: Legal Lasso: Don’t Sue Your Nephew | Law Week Colorado

I have an almost 14 year old son who has never said the words I love you to any of the dozens of people that he adores who all adore him in return. Each would love to hear him be able to voice that as he jumps into their arms (something else he’s ohysically incabable of). It’s about perspective and priorities.

@Mitch – Over 50,000 Canadians a year spend money on US medical services because of substandard Canadian care. I am Canadian so you can’t pull the wool over my eyes like most Canadians do to Americans.

But again, having a debate over universal healthcare is pointless and frivolous, because the plaintiff in this case was apparently not uninsured in the first place, as far as I can tell. The comments from the plaintiff and her attorneys are tellingly ambiguous on that question. My read of all of their comments is that she wanted money damages to pay for future surgery that she believed she was entitled to. If it is true that she is medically entitled to future surgery, her health insurance plan will likely cover it.

Really, the only interesting thing about this suit was the degree of care that an 8-year-old should exercise. Everything else was run-of-the-mill.

The only reason folks are talking about it is because the Connecticut Post manipulated readers with clickbait:

The Media Hit Job on the Evil Aunt

@Eric Turkewitz –

Oh boy, that is certainly a good basis upon which to do legal analysis.

Perhaps this is a misunderstanding of venue… Jack doesn’t necessarily provide legal analysis (he will if it pertains to the subject, but I think he was clearly not in this case), he discusses ethics, and legal ethics are different from ethics as a whole.

What Jack Marshall does is itself distinct from ethics as a whole. He uses the term “ethics” to add legitimacy to what are simply his personal views on things. “Feelings Alarm” would be a more apt title for his blog. Since Turk and Jack have crossed paths before, Marshall most certainly knows the nature of this venue; he simply doesn’t care because he believes that he’s always right. He is the Black Knight in Monty Python and the Holy Grail, always willing to fight regardless whether he has any remaining limbs to stand on.

Since Turk and Jack have crossed paths before, Marshall most certainly knows the nature of this venue; he simply doesn’t care because he believes that he’s always right. He is the Black Knight in Monty Python and the Holy Grail, always willing to fight regardless whether he has any remaining limbs to stand on.

How appropriate.

Monty Python and the Black Knight

It must be genuinely horrendous living in America and having to put up with appalling, untenable, systems such as this.

Honestly, get yourselves a health service.

I didn’t think you could sue a child.

@JJ – As has been repeatedly pointed out in these comments, the universal-healthcare debate is completely irrelevant to this case. I have yet to see any suggestion from anyone that the woman did not have health insurance. Said in another way, it appears that the woman had health insurance. I.e., the woman was protected from paying medical expenses. Commenters like JJ are repeatedly confusing health insurance with liability insurance.

Don’t blame the people responding to the story, blame the news outlets completely misrepresenting the story.

Don’t blame the people responding to the story, blame the news outlets completely misrepresenting the story.

I did!!

The story wasn’t leaked – most of the repeats were verbatim repeating of the ghastly little local paper’s coverage on a slow news day (I don’t think there was a jam competition)

I’m sure this is a completely impartial commentary on the situation and is in no way influenced of biased by the fact that you make money by representing the same sort of selfish person who would sue a small child for a six-digit sum over a minor thing he did by accident when he were eight years old.

Or you may have just cobbled together an inflammatory “opinion” post in hopes of stirring up traffic and getting your firm some free publicity.

@Nunajer

Funny stuff! Maybe next you’ll read before writing?

This makes absolutely no sense. If the insurance company already refused payment they aren’t going to reimburse the little boy’s family if she had won this case. So, the only people out money for her injury are her relatives.

@Eric

Thanks for the level-headed and calm analysis – something quite missing in the furor over the headline(s).

Questions? Why could’t the family file a claim on their home owners insurance? Why did the relative have to sue? If they felt responsible, then they could have filed a claim. Then, most likely, their rates would have gone up and pay the 1% deductible? And did the victim not have insurance? What about the great Obama Care? That didn’t cover her injury? And was the $1 settlement offer by the insurance company a “sue us” if you think you will win? So the entire system is built to produce lawsuits, not actually insure people who come to your house are protected and receive medical care?

@Dix – that is such a false statement it isn’t funny, maybe YOU should look into the facts on that, and I’m a Canadian living in the USA, I seriously miss the healthcare back home! I’ve neve in my life met someone who “flocked to the USA for healthcare” unless they wanted a cosmetic procedure because there is a wait time for surgical suites for non emergency surgeries.

Cut it out with the Canadian healthcare debate. The post is not about that.

Go figure, a personal injury lawyer justifying some ridiculously litigious crap.

No matter how you slice it, this was an example of ridiculous litigation. The aunt herself wasn’t seeking the insurance company…she was, by her admission, teaching her nephew accountability.

Another genius who comments without reading.

Good grief! An 8-year-old boy? Throws himself into the arms of his aunt? Without warning? His parents should be sued for not controlling a very moronic child who has no sense at all.

After reading your piece, and all the commentary, it’s still not clear to me why this is not an “American healthcare system is crazy” story. If the suit had been successful (and assuming that the injured party had health insurance), what would the insurance company have ended up paying for? Was the money sought not for the purpose of covering the costs of treatment for the injuries, but instead to compensate her for losses and pain suffered as a result of those injuries? I think a number of commenters, including myself, were not clear on this point; it would be nice to get it cleared up. Merely telling us to “cut it out with the Canadian healthcare debate” isn’t very helpful.

On a similar note, it seems awfully strange that this would have anything to do with “homeowner’s insurance”. Does that mean that if it happened in someone’s yard, an insurance company might pay, but if it happened in a park, too bad?

After reading your piece, and all the commentary, it’s still not clear to me why this is not an “American healthcare system is crazy” story. I

Because even if she wanted to include a claim for pain and suffering against the homeowners policy it would have been her right to do so. But she was clear she was only going against the policy — not the kid’s piggy bank.

While I thought liability was very weak in this case, as I said in the piece, I look at the bigger picture of friends/family bringing suits against each other on the same basis after car crashes.

Do you think the better case, liability wise (meaning a case the insurance company would have had to consider more seriously) would have been negligent supervision against the parents? Negligence on an 8 year old acting like an 8 year old is hard. Less so for parents failure to supervise.

Negligence on an 8 year old acting like an 8 year old is hard.

That is why I said I would never have taken the case. I think a negligent supervision claim would have also resulted in a defense verdict, though it may have blunted the e-shaming backlash.

Nope that woman and her lawyers are below human, and deserve all the flack they get. Esaplly her, suing her own nethew after the mother (her sister died)

Esaplly her, suing her own nethew after the mother (her sister died)

I love the way folks make shit up and then pretend that is the reason for their opinions. The mother actually died a couple years after suit was brought.

Not that you would care. You’ll have to go hunt down some other reason to be venomous on the interwebs.

The alternative is to actually read with considered thought.

Now… my son broke his wrist (much minor than this, but still the medical bills are high) in a science museum for kids. It was absolutely not unsafe. He fell from a very small distance (less than one foot) and it was just bad luck. Our medical insurance sent us a letter asking if it had been the fault of a third party. We consulted with my sister in law and she explained how it is almost protocol for the insurance company to ask that. So we answered no, it was nobody’s fault and they did pay. We did have to pay the co-pays for the check-up visits, x-rays and so on, which were maybe like $150. I guess we have much better coverage than this woman?

I will confess, I was someone who made a derogatory comment about the aunt. Given the now revealed fact of the case, I hope the aunt can sue the insurance company that required the initial suit for defamation of character and liable

I hope the aunt can sue the insurance company that required the initial suit for defamation of character and liable

It wasn’t the insurance company that tarred and feathered her. It was Daniel Tepfer of the Connecticut Posy that did the tabloid hit job that other media followed like sheep.

Extra, Extra, Read all about it.

Over here in the UK, this sort of concept is alien to us. I would never have thought that it was to get an insurance company to pay for the operation… because that’s what the National Health Service does. You don’t need to have an insurance policy to pay for surgery after an accident – that’s the role of the state.

I’m still not understanding. Would this normally be homeowners’ liability or bad luck?

Also–is this really a case of the health insurer subrogating and insisting the Aunt cooperate? Or did her medical insurance just not cover this?

I have not seen any information on what her insurance did, or did not, cover. I decline to speculate.

@Tom Donahue – Most medical insurance policies contain subrogation provisions that require a liable party’s insurance to pay. Her medical insurance, if she has it, could even refuse to pay if they think the homeowner’s policy should.

On what basis do you claim that her medical insurance could refuse to pay based on the homeowner’s policy? This is apples and oranges. First party medical insurance v third-party liability insurance. A source of incredible confusion in the comments.

On what basis do you claim that her medical insurance could refuse to pay based on the homeowner’s policy?

This post was about yellow journalism and how a reporter manipulated his readers.

Why didn’t she simply file a claim against HER OWN MEDICAL INSURANCE POLICY ? That’s what I’m curious about. Was she uninsured. If so, that is the issue.

Of course it’s not surprising a jury would not find an 8-year negligent for jumping into his aunts arms even with no warning. That’s what 8- year old kids do. That said, people sue family members all the time. That’s why I have friggin’ homeowners insurance in case people are injured on my property. Who do you think is most likely to be visiting me on my property ? Relatives. Duh. People are morons so the comments will be mostly uninformed and idiotic. I don’t know how you have the patience to review them.

Pingback: Expecting The Worst | Associate's Mind

Pingback: The Evil Aunt Who Wasn’t | In•de•fix•a

Pingback: Al Sharpton, the NY Post and Yellow Journalism | New York Personal Injury Law Blog