New York’s annual legislative session ends Wednesday. And that means, predictably, a mad rush to get legislation enacted without having to wait another year. Or, conversely, a mad rush to stop legislation.

And that’s where we are today, with Geico attempting to halt legislation that would hold it (and other insurance companies) accountable for bad faith in settlement negotiations. Yes, out-of-state-readers, it’s true, New York currently has very limited ways to stop insurance companies from trying to screw you over in your time of distress.

This legislation was first proposed in the wind-swept wake of Hurricane Sandy in 2013, when insurance companies thought it would be a really cool idea to deny coverage for damaged homes. If a policy excluded wind damage, the insurers would claim water was to blame. If it excluded water damage, they would claim wind was to blame.

The denials had a common background – they were dealing with people who had their homes destroyed and were, therefore, in great economic distress. Because everyone needs a roof over their heads. So the denials gave the insurance companies some, let’s call it, leverage.

Delay and delay and force the homeowners to hire lawyers to sue. Then, when the pain is deep enough and the homeowners desperate enough, maybe settle for 50 cents on the dollar. Or 70. But even if the insurers had to cough up 100 cents on the dollar on some claims, so what? That was merely what they had to do anyway. Every cent saved was profit.

And that is part of the base model of the insurance company: Take in as much as you can in premiums and pay out as little as possible and invest the money in the interim.

The legislation that is proposed, that Geico is afraid of, would put a stop to that as well as bad faith tactics in auto policies and elsewhere.

Right now, in an auto case, if an insurance policy is only the bare minimum $25,000 or maybe $100,000, and the damages are $500,000, the insurance company has a vested interest in offering only a portion of the policy. Sure, it’s possible that someone will spend $20,000 and try the case to verdict. But that often makes little economic sense, and all the lawyers know it. You can win but still lose. So why offer the whole policy even if you would, in good faith, owe it?

The only avenue for relief currently is to take an excess verdict against the insured when the insurance company has elected to put its own interests ahead of those customers, because you can’t sue the insurance company directly.

And then, and only then, if the insured is smacked for a big, fat verdict in excess of the insurance policy, there might be some relief. But that relief only comes if the defendants — who you just sued and perhaps, inflicted a bit of anxiety on — then assign their own rights to sue the insurance company for bad faith back to the people that had sued them. And if those people are gone? Or say “screw you, we don’t feel like helping you as we got nothing to take anyway so it doesn’t matter to us?” Well, sorry Charlie.

The bad faith legislation that is now pending would fix this problem, a problem created by the fact they are currently required to act in good faith but there is only one very poor method of enforcement.

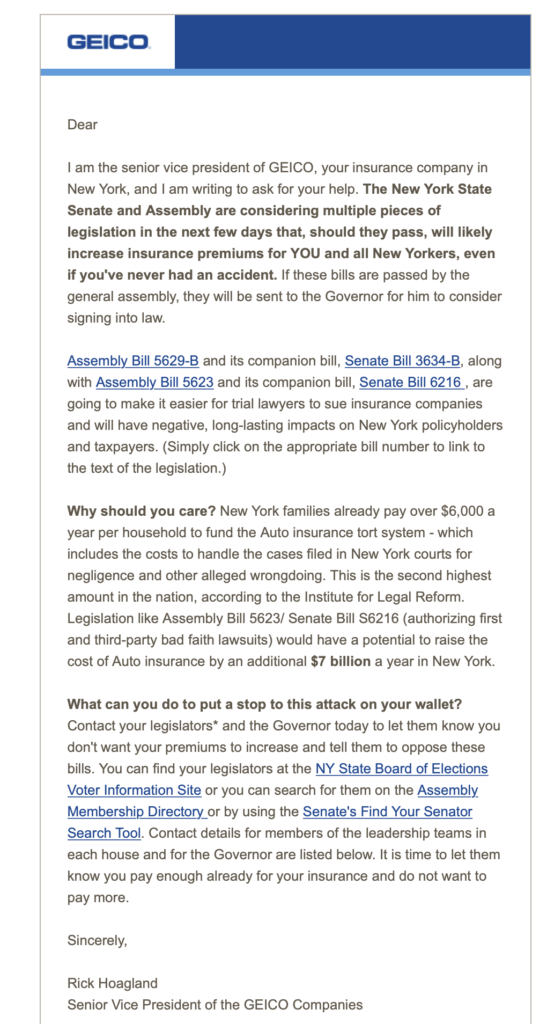

Enter, stage right, Geico to oppose this common-sense legislation. In a mass email yesterday from Rick Hoagland, a Geico senior vice president, to its policy holders, it urges people to call their legislators to stop the legislation and protect the insurance company profits.

OK, maybe Hoagland didn’t word it quite that way. He claimed, instead, that legislation protecting both policy holders and the people they may injure would somehow be bad for them. George Orwell would have been proud.

He writes, instead that:

I am the senior vice president of GEICO, your insurance company in New York, and I am writing to ask for your help. The New York State Senate and Assembly are considering multiple pieces of legislation in the next few days that, should they pass, will likely increase insurance premiums for YOU and all New Yorkers, even if you’ve never had an accident.

He doesn’t say it would increase premiums but rather, he speculates. He provides no empirical data. More importantly, he doesn’t tell his insured that the legislation protects them from the bad faith practices of Geico, the company that they paid money to in order to protect them in the event something goes awry. And it is those bad faith practices that could put their own homes at risk in the event of a verdict in excess of their insurance policies.

And, of course he doesn’t tell his readers that the bills are designed to protect them. No, he claims that they “make it easier for trial lawyers to sue insurance companies.”

Here’s an idea, why not just put us personal injury lawyers out of business by dealing in good faith to begin with? Look, Geico I solved your problem! (You’re welcome. No charge.)

Here’s the Geico pitch, compete with links to the bills, which I urge people to read so the they know they are consumer protection bills. The reason he provided links is because he knew, no doubt, that few people would actually click them or get an explanation as to their true purpose:

Assembly Bill 5629-B and its companion bill, Senate Bill 3634-B, along with Assembly Bill 5623 and its companion bill, Senate Bill 6216 , are going to make it easier for trial lawyers to sue insurance companies and will have negative, long-lasting impacts on New York policyholders and taxpayers. (Simply click on the appropriate bill number to link to the text of the legislation.)

The legislation would allow a direct case against the insurance company for bad faith, so that the victims don’t have to rely upon the people they just sued to tender their rights against the insurers.

Geico, of course, would like to make enforcement of good faith laws difficult, thereby giving it a certain level of immunity. Why not offer 20K on a 25K policy when you know it will cost the injured plaintiff that much just to try the case? There’s almost no downside for them for acting in bad faith.

It’s time New York finally put a stop, once and for all, to the bad faith of insurance companies. The law requires good faith dealing and the Legislature should give consumes the tools to enforce it.

The email is here: